Seamless Childcare in BC Schools Is Gaining Momentum

For seamless childcare to reach families province-wide, school districts need ongoing funding and policy support from the provincial government.

As parents, we strive to teach our children life skills and help them be ready for the real world. A vital component of that is financial literacy. From budgeting to personal financial management, financial literacy is understanding and applying various financial skills.

Experts now agree: It’s never too early (or too late) to teach kids about money. Money is an excellent teaching tool. Kids will learn about money whether you take an active role in that education, or not.

The great news is that the daily routine of managing budgets, paying bills, and finding that balance between working hard and spending time with family, can all become great teaching opportunities. Each task and each decision can be used to help teach your children about the value of money, the need to understand spending and saving, and the importance of giving.

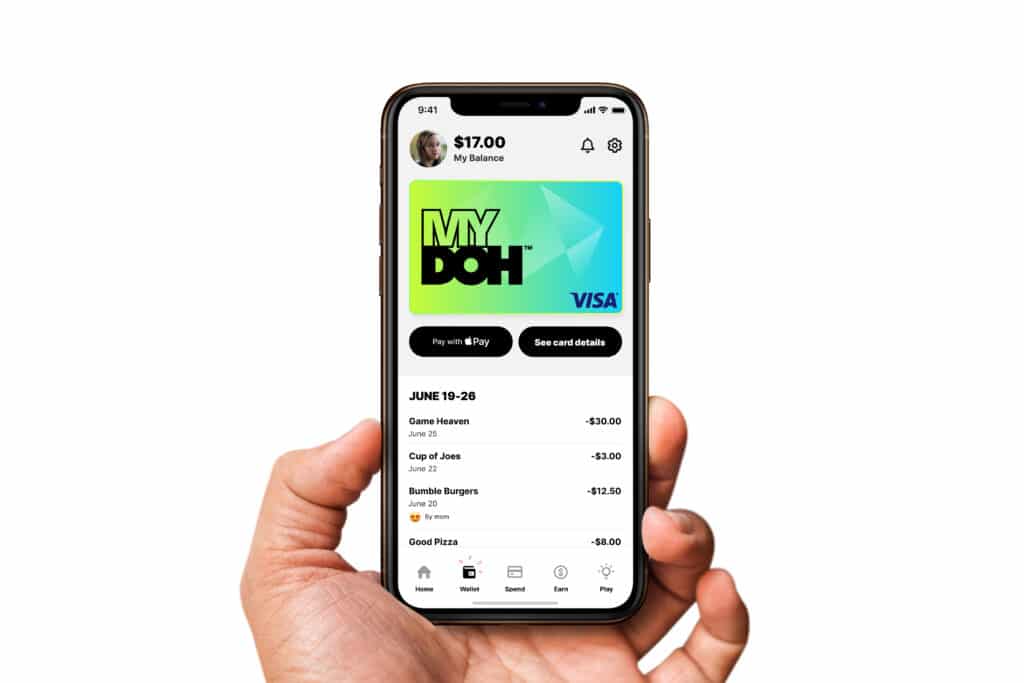

If you’re looking for a helpful app to get started check out Mydoh, powered by RBC. It is a helpful tool to educate and show your children the comings and goings of their money while learning how to make smart money choices. It’s a money management app and Smart Cash Card (which includes a digital and physical Visa Prepaid Card ) that helps kids make their own earning and spending decisions — instilling values that help build a strong foundation for the future. Kids can learn responsibility, earn money through tasks and allowances, and spend responsibly using the Smart Cash Card.

The Mydoh app and Smart Cash Card make it easy for kids to gain real money skills. Your kids learn money basics through Play, earn their own money through Tasks, and spend it wisely using their Smart Cash Card. And, it all starts from your Parent Account and using the tools provided.

Once you install the Mydoh app both parent and child become account holders and they can get their preferences set up. You can also add a second parent to your Mydoh account at no extra cost, with just a few clicks within the app. Adding a second parent means you can share the responsibilities and tools to raise money-smart kids. Each of you can set tasks for kids, pay them when they’ve completed the tasks, set a weekly allowance, and add funds to your kids’ accounts. You can also track goals and spending together – getting the whole family involved!

▪ Setting up tasks and allowance

▪ Sending your kids money instantly

▪ Tracking earning and spending

▪ Reacting to transactions with emojis

▪ Locking and unlocking kids’ cards

▪ Manage their tasks

▪ Mark tasks as complete

▪ Spend with their Smart Cash Card up to the allowable limit

▪ Track earnings and spending, and see the balance

▪ Learn money basics through play

Mydoh believes in giving children the ability to learn healthy and sustainable earning, saving, and spending habits helping them develop important financial values while instilling confidence in their ability to manage their own money for life. While backed by the security and trust of RBC, Mydoh is also available to customers of other Canadian banks. To help get your child managing their finances download the Mydoh app at www.mydoh.ca

This article was sponsored by Mydoh

For seamless childcare to reach families province-wide, school districts need ongoing funding and policy support from the provincial government.

Do you remember how delightful Christmas holiday was when you were little? If the countdown to Christmas is stressing you out, it just means you’ve grown up! Read these tips to reclaim the magic of the holiday season.

Childcare nutrition programs do much more than provide food—they supports the development of lifelong habits and social-emotional skills.