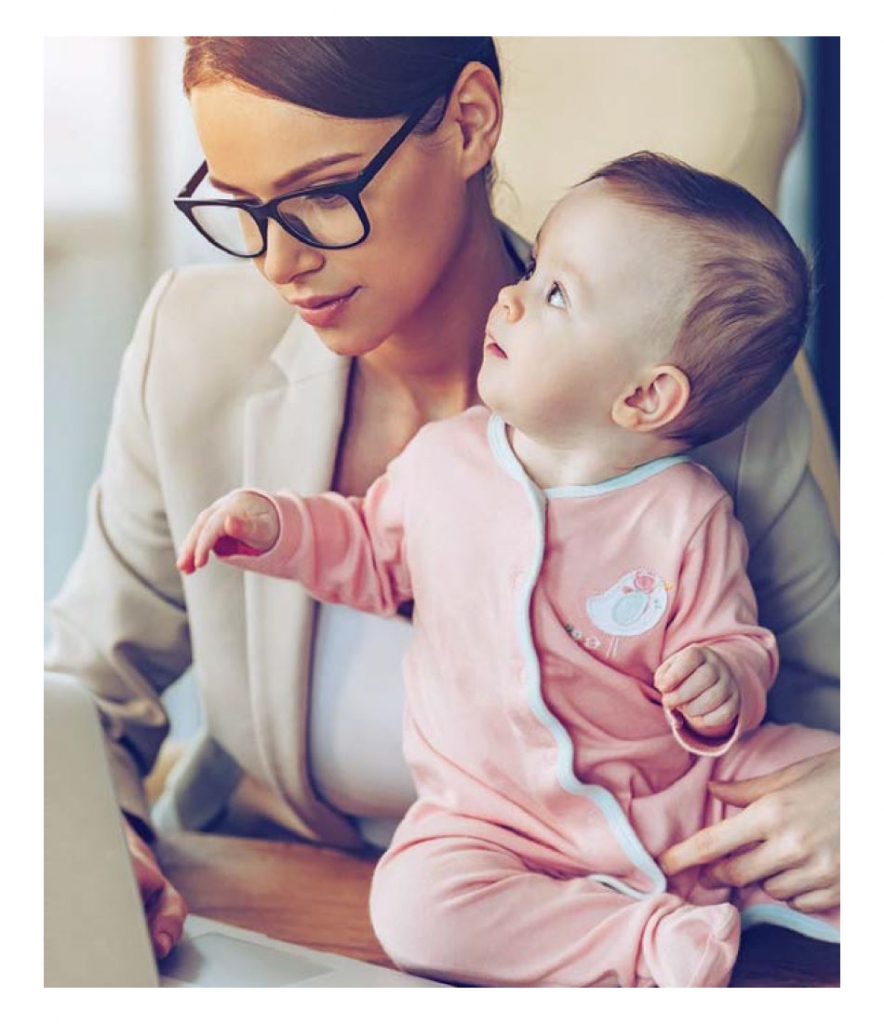

Beat the Holiday Blues: Single Parent Edition By Sarah Jones

Do you remember how delightful Christmas was when you were little? If the countdown to Christmas is stressing you out, it just means you’ve grown up! Read these tips to reclaim the magic of the holiday season. Holiday Planning Like a Pro There’s a plethora of preparation involved for Christmas when you’re the only one…